Being financially literate is one key to economic stability. It includes understanding how to make smart financial decisions, budget effectively, save for the

The holiday season is just around the corner. While Andy Williams is famous for crooning that it is the “most wonderful time of the year,” the reality is that

The U.S. dollar is declining in value compared with a basket of international currencies. The greenback has fallen 5% in the last two months, and now sits at a

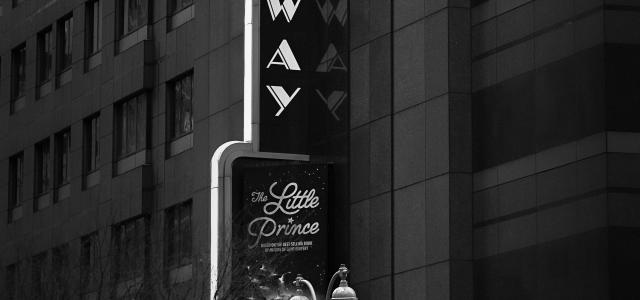

Some of you probably know that my wife Sharon and I could be lovingly referred to as theatre nerds. For some, a trip to the Outer Banks or Disney is their

Quote: “The single biggest problem in communication is the illusion that it has taken place.”

- Communication extends far beyond the words we say. It requires

What was the last money mistake you made?

If you’re like most folks, you’ve made at least one upsetting money mistake in the past year — and you’d like to

One of the decisions we all need to make in retirement is how do we want to be cared for in our later ages when we may need some assistance. I think for most

Stories, both fictional and true, are often great ways to learn lessons. Throughout history people have used storytelling to teach people important lessons

During February most of us begin to slip on our New Year Resolutions. The promise of what could be is now never going to be unless we find a way to recommit.

A