You have worked hard and saved diligently. Maybe You have done OK investing on your own for several years but now you want professional advice as your finances become more complex. Or, maybe You have managed your own portfolio successfully since the beginning of your career but have reached the point in life where you want more time for other pursuits and/or you are ready to offload the management of your assets to a trusted professional.

WWA can assist with your investment needs no matter what your situation but, as a financial planning firm, our skill set is much broader than investment management alone. We want you to “enjoy the journey” as much as possible while working toward a financially secure future.

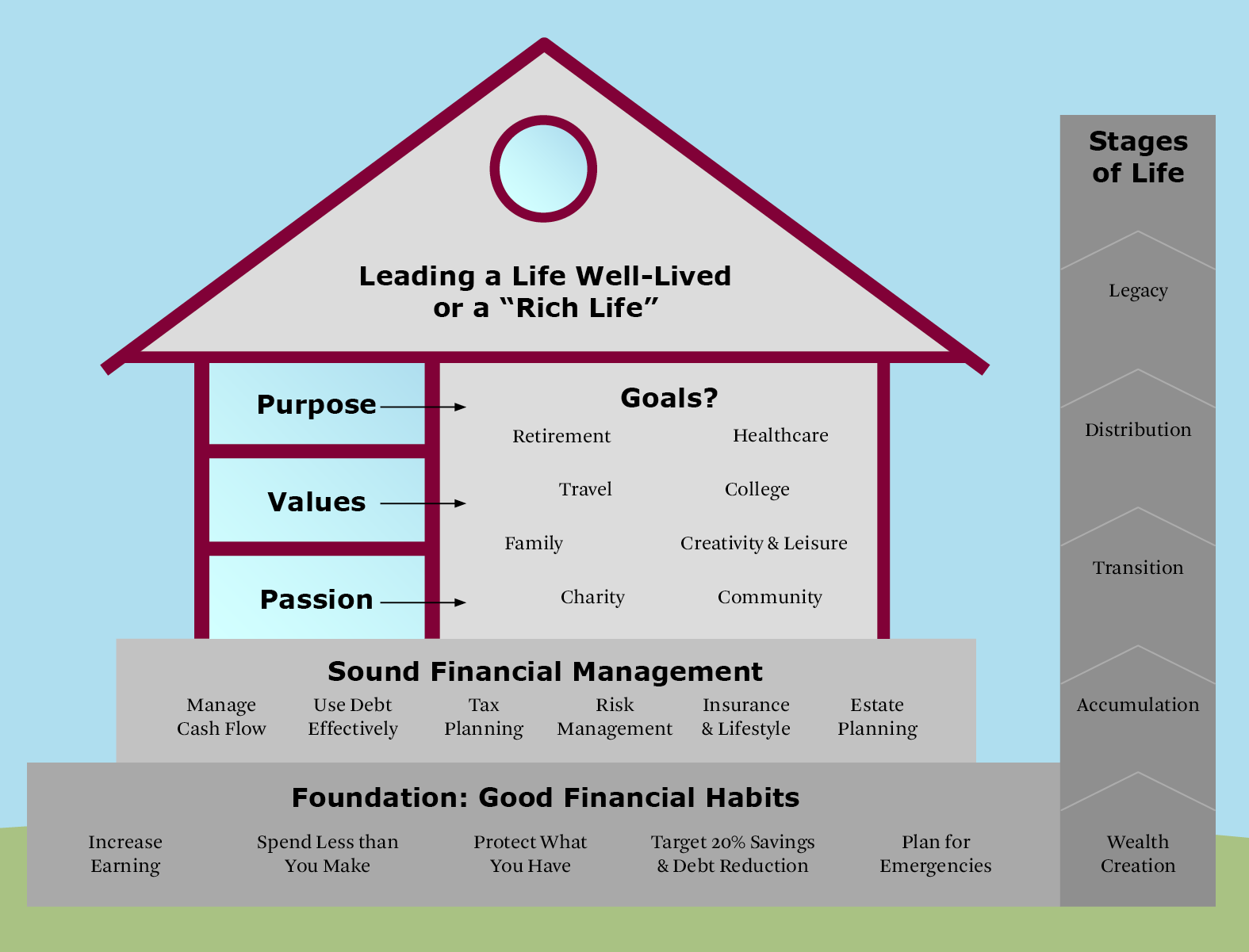

To create a plan that provides that balance, we ask questions about your life goals and values.

- What do you think will bring meaning and purpose to your financial life?

- What would you like to accomplish or experience so that, in the end, you will feel you have lived your life fully?

- What would you do if you had more time and money?

- How would you define living a “rich” life?

Identifying what is most important in your life is critical to the financial planning process. Once we know what your values are, we can help you align your spending and investments with them. At a more fundamental level, all the money in the world will not bring you satisfaction unless you recognize what is important to you.

Fee Structure

Fees for ongoing financial planning and portfolio management services for clients with investable assets of over $600,000 are determined by a percentage of assets under management, the number of client accounts, complexity of their financial situation, and planning needs.

Annual Fee Schedule

|

Assets Under Management |

Annual Fee % |

|

First $0 - $1,00,000 |

1.00% |

|

Assets between $1,000,001 - $2,000,000 |

0.85% |

|

Assets between $2,000,001 - $3,000,000 |

0.75% |

|

Assets between $3,000,001 - $4,000,000 |

0.65% |

|

Assets between $4,000,001 - $5,000,000 |

0.55% |

|

Assets of $5,000,001 and above |

0.50% |

For households with less than $600,000 in Investable Assets:

Although WWA does not require a minimum asset level as a prerequisite for client relationships, we ask clients with an asset base of less than $600,000 to pay an age-based minimum as follows:

|

Age |

Minimum Annual Fee |

|

20 – 30 years |

$2,400 |

|

30 – 40 years |

$3,600 |

|

40 – 50 years |

$5,400 |

|

50 – 60 years |

$6,000 |

Clients pay the greater of their age-based minimum and their asset-based calculated fee. We may negotiate different fee arrangements for clients in unusual circumstances.