Stop It!

Readers of a certain age will probably remember Bob Newhart, one of the first successful stand-up comedians. While he continued his solo comedic work for most of his career, Newhart enjoyed even greater success on TV and in film. His first leading role on TV had him playing a psychologist in the Bob Newhart Show. Several years later, he reprised that role in a MadTV sketch. The clip I linked to is generally known by today’s title. It’s a six-minute video that might be fun to watch (unless, I suppose, you are a psychologist). In it, Newhart gives the same (obviously humorous) two words of advice to every patient who enters his office regardless of the issue.

I was reminded of that sketch recently when a client (what else, a psychologist) came in with concerns about nearing retirement with the stock market in one of its periodic correction phases. As we tried to calm him, suggesting that he try not to worry, he brightened up and said: ‘Wait, I get it. Stop it!’ Exactly.

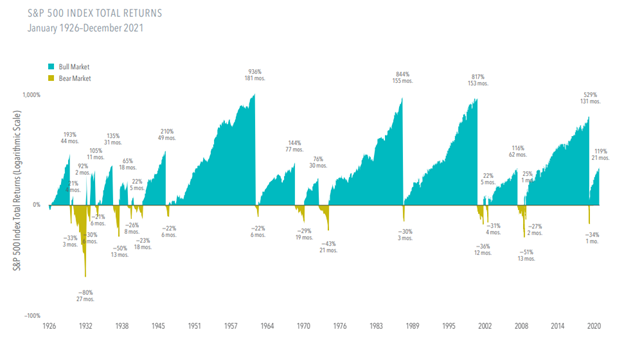

When market fluctuations provoke an anxious ‘What should I do?’, we come back with another question: ‘What’s changed in your personal situation?’ The answer is almost always the same: ‘Nothing’. That makes our subsequent response easy: ‘Don’t make any changes in your investments right now either’. How are we able to react unemotionally to what seems to be a significant loss? Because in our experience, corrections are simply part of markets. To help illustrate, here’s a helpful chart from our friends at Dimensional Fund Advisors:

You can see that the longest ‘bear market’ (a correction of at least 20%) happened during the Depression and lasted over two terrifying years. The shortest was the COVID correction of 2020, lasting just one exciting month. Perhaps you also notice that there are about an equal number of ‘bull markets’ (gains of at least 20%). Their average duration has been around five times longer than ‘bear markets’. These facts, taken as whole, allow us to respond with a reasonable level of confidence despite headlines that are designed to make us all nervous.

Just to be clear, the chart above isn’t representative of our clients’ actual results since the S&P 500 is made up of only the stocks of large companies headquartered in the US. Our portfolios are significantly more diversified, including bonds, smaller company stocks, real estate investments and overseas companies. But when most people think about ‘the market’ they are referring to the S&P 500, so using this chart provides us with a useful shorthand.

The marketplace generally rewards businesses for providing a product or service more efficiently than their competition so those companies enjoy increasing valuations. We, as investors, are allowed to tag along via stock ownership. Over the years I’ve met many people who like to ‘play the market’. To us, this is not play. Our clients entrust us with their hard-earned money and we try just as hard to earn more for them. About a year ago I quoted famous investor Peter Lynch and I’m going to do so again today: ‘Although it’s easy to forget sometimes, a share is not a lottery ticket… it’s part ownership of a business’.

We get relatively few calls from clients during such times of market-related panic, perhaps because they already know how we’ll respond their questions. However, some of our newer clients and non-client friends do share their concerns about those dire headlines. We gently remind them that headline writers don’t exist primarily to provide information. Their job is to encourage you to tune in again later or buy the next issue: basically to sell advertising.

Although we are somewhat more polite than Bob in the sketch, our response is pretty much the same. Please try not to worry about your investments. We believe that a long-term strategy of investing in a diversified mix of stocks, bonds and real-estate will provide sufficient returns for all.