Technically

I’ve heard that you can tell whether someone is an optimist or a pessimist by their answer to the question “Which do you want first, the good news or the bad?” I’ve started a couple of businesses during my working life, something that’s almost always associated with optimism. Yet my usual response to that question is to ask for the bad news first. I don’t dwell on the negative as much as I prefer to learn about problems as quickly as possible so I can try to resolve them.

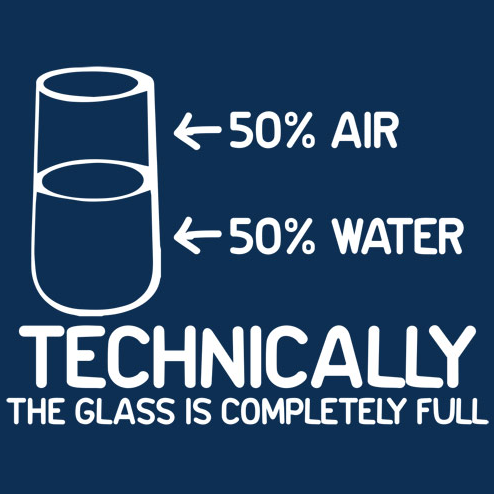

I don’t suppose either optimism or pessimism is inherently good or bad but here’s a graphic I found at a clever T shirt site which makes me think I’m actually a bit of both.

I’m generally optimistic but I know that things can go wrong so planning for that eventuality just seems prudent. In fact, I spend a lot of my time thinking about the possibility that something might not work out just the way a clients hopes.

I don’t focus on what might go wrong as much as I try to anticipate a range of future outcomes, then figure out ways to mitigate the most severe of them. Attempting to manage risks is an integral part of my job.

Many of our clients entrust their investment decisions to us. When we assume that responsibility, we take the buying and selling of stocks and bonds very seriously. Since I’m generally optimistic, most of our clients are fully invested most of the time. However, because I also consider possible negative outcomes, our investment strategy always includes “insurance” against market corrections, usually involving one or more hedging strategies. Even then, our record is not perfect. Our clients’ account values fell during both the 2000 and 2008 corrections but losses were significantly smaller than the markets broadly. That meant their account values returned to pre-correction levels sooner and, since we never got out of the market, we didn’t have to figure out when to get back in.

Even for those of us who do it professionally, investing is a very humbling activity. Whether I’m taking a 30,000 foot view of the market or deciding exactly which stock to buy at what price, one fact remains: markets are made up of a willing buyer being connected with a willing seller, i.e., an optimist and a pessimist. There’s always someone who thinks it’s time to sell when I’m ready to buy and vice versa. Before making a decision to trade, I stop and ask myself what the other person might be seeing that I’m missing.

Our clients come to us for help with a wide range of questions about investments, retirement or estate planning, taxes or insurance. We’re pretty-well equipped to answer them but, in addition to our training and many years of planning experience, we also bring the ability to step back and offer an outside perspective on the situation. Whether it’s helping someone answer a knotty question or standing by them through a crisis, we try to maintain a level of professional detachment. It’s not that we don’t care, it’s that we deliberately remain a bit removed so we can view the situation less emotionally.

Whether we’re optimistic or pessimistic about the future, life is never going to work out just as predicted. Some people need help anticipating and planning for things that might go wrong, others encouragement that things will probably be OK. Take another look at the graphic and think about your own tendencies. Neither your worst fears nor your fondest dreams will always come to pass, so considering the alternative may be a helpful exercise.