Keeping Score

Individuals as different as H. L. Hunt (Money is just a way of keeping score) and Mae West (The score never interested me, only the game) have commented on how money affected their lives. A few years ago, I wrote an article called This Just In: Apparently Money Can Buy Happiness in which I cited research suggesting that people with more money are happier than those with less but not necessarily in proportion to increased wealth. The research was updated at a more granular level last year. There appear to be twenty or so percent of people who really never find happiness but the more recent conclusion is that generally, people are happier in proportion to their income without an obvious cap. Still, from what we’ve seen, being able to maintain a comfortable lifestyle is a much greater barometer of ‘happiness’ than is great wealth.

Attitudes about money often shift as people move from full-time employment to retirement and helping people make that transition is an important part of our work. We sometimes encounter those who are afraid they don’t have enough money to retire. In fact, more than once, individuals or couples have delayed calling us, afraid the news might be bad. They didn’t want to hear us say that they need to keep working in order to cover their expenses in retirement. Fortunately, that’s rarely the case. In fact, after over thirty years advising people about their investments, I can’t think of more than a couple of instances when we couldn’t find a way to make the numbers work.

Our approach to retirement finances is quite simple: we just require a balanced budget. Whether retirees keep their investment accounts and continue paying on a mortgage, reduce their account balances, or utilize a reverse mortgage doesn’t really matter. We just want income to cover outgo.

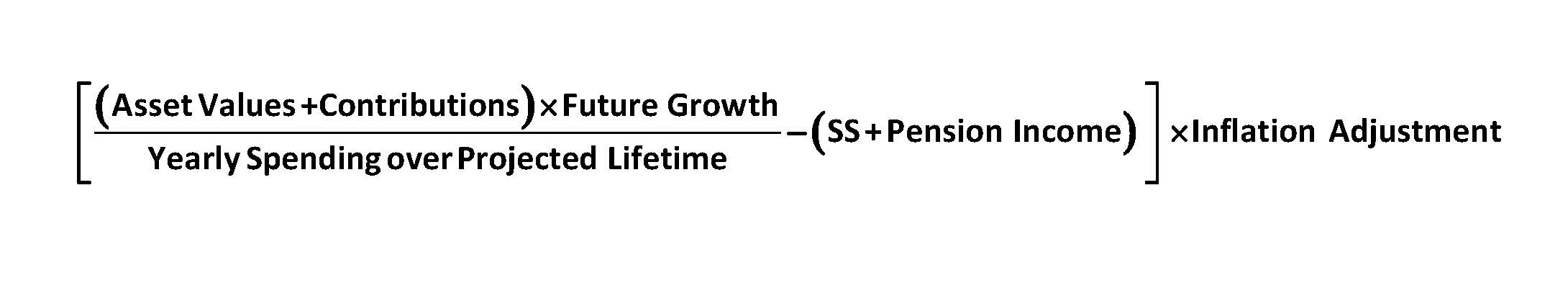

Does that statement beg the question of how much is required to make retirement financially feasible? Here’s a formula I developed for projecting the amount of assets necessary to maintain a retirement lifestyle similar to that enjoyed while working:

If that doesn’t seem helpful, do a web search for ‘Retirement Income Calculator’. I just tried it and found over five-million links. A list that large is probably of little value either, so here are two calculators for your consideration, both from companies we trust. First, from our primary asset manager Dimensional Fund Advisors and second from the well-known Vanguard family of funds. Of course, we and other planners are available to provide a more personalized review of your situation should getting a more detailed answer seem like a better idea.

A frequent question is ‘are we on track with our retirement savings?’. Well, generalizations may not tell the whole story but here’s a chart from the Economic Policy Institute showing the median (mid-point, not average) amount of family retirement savings by age group.

What does this tell us? That, unfortunately, most families have saved very little for retirement, even those in their late 50s who should be in the best financial condition of any age group. Perhaps it also tells us that no one should be afraid to seek advice about their retirement finances.

There are several ways to resolve a lack of sufficient retirement assets. In some cases, part-time work will do the trick. Remember, if you’re retired and short of funds, a half-time $15 per hour job has about the same effect as having an additional $375,000 in savings (using a 4% withdrawal rate). Here’s a link from the Washington Post that describes several family situations in which continued earning has taken care of finances. In other situations, taking in a roommate, moving to a smaller dwelling – perhaps even an apartment – or getting rid of a mortgage payment might be the best approach. Regardless, ignoring the issue is not going to provide you with retirement security.

I have shared this riddle before but perhaps it bears repeating:

When is the best time to plant an oak tree? 50 years ago.

When is the second-best time? Today

Please take positive steps right now to ensure that your own retirement will be a comfortable one. Collect the relevant facts, make or adjust your plan based on that knowledge and consider changes to your financial behavior that will improve your results. We, of course, would be happy to help.