The Calculus of Market Movements

Calculus, as you may remember, makes it possible to compute the area under a curve by imagining a series of narrow rectangles. The secret to the calculation is that if you make the rectangular slices infinitely narrow, each section of the curve can be thought of as a straight line forming the top of a rectangle. When the lines are seen together, they form the curve, so when their rectangular areas are added together they tell us the area beneath by the curve.

Today, I’d like to think about those very short straight lines in relation to the stock and bond markets. If the stock market has a significant down day like Feb 28th (sample headline: MARKETS CRASH!) or up day like March 2nd (sample headline: BIGGEST ONE DAY GAIN EVER!), it’s important to remember that each of those events is just one of the small straight lines which make up the complex curve of market movements.

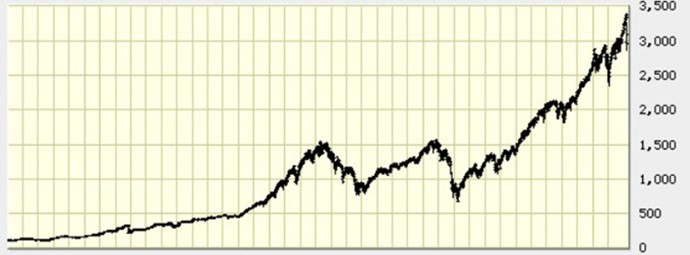

News writers, whose job it is to grab attention so that people come back for more, make their living by coming up with headlines which draw attention. This almost inevitably involves trumpeting the day’s ‘straight line’ as the beginning of an important trend. History shows that neither their headlines nor their predictions are very accurate. Please consider this chart of the Standard & Poor’s 500 since 1980.

While the peaks and valleys are quite obvious, the long-term trend is too. One of the most difficult elements of successful investing is discipline: nourishing the ability to ignore the 24/7 noise, those daily straight lines, and focusing on the idea that when you’re investing in stocks, you’re one of the owners of the best companies in the world. Of course, there will be multiple good and bad days - and even months - along the way. However, the most likely outcome is that the world’s economy will survive and markets will provide a reasonable rate of return to investors.

I started writing this article just as the markets fell on fears about the spread of the Corona virus. First Trust is one of the companies which packages Exchange Traded Funds for retail investors and they provided this chart showing the long-term impact of various earlier epidemics.

Regardless of health fears or any other fears, markets have always adjusted to new realities and moved on.

By the way, what happened to the money people received when they sold their stock last week? Much of it was used to purchase bonds, driving bond prices up and interest rates down even further. That means that if you owned a bond (or had invested in a bond fund), you actually made some money even as the stock market was falling.

If there was a fail-safe, risk-free, way to make money in the markets, it would have been discovered by now. What we believe is that by remaining calm in the face of inflammatory headlines and making considered moves among market sectors based on thorough research, it’s possible to make money for our clients without assuming undue risk.

In the period leading up to the Second World War, the British government came up with this well-known slogan and sign:

It seems a good approach to investing too, reflecting our views almost perfectly.

Please try not to live your life in the headlines but take a step back and reflect before you act. I’m guessing both your wallet and blood pressure will be better off for it.